Tega Industries Ltd - Steady Growth Incoming?

A quick dive into the world's second-largest producer of polymer mill-liners

Dear readers,

I’m happy to announce that I’m now a SEBI-registered Research Analyst!

This did not come easy and was an arduous but rewarding process. I have to applaud the officials at the Market Intermediaries desk of SEBI for being very cooperative and responsive to my queries - this helped a lot in getting the license in the first go.

With that being said, my team has now embarked on providing our subscribers with stock research reports as per SEBI guidelines, which includes price targets.

Some of these reports are going to be free, and some of them are going to be for paid subscribers only - I truly hope that my readers will get the value for their subscriptions as I have been evaluating winning stocks for the past 15 years.

You can also reach out to me on Instagram for your stock queries at: @ajayinvests or @themoneymemo. I have a community of around 5000 followers there.

I’m hosting an Insta Live on @ajayinvests this Sunday, 10 Dec 2023 at 6:00 pm IST on How to Invest in U.S Stocks - Join me for a discussion on how to set up a brokerage account to trade U.S securities from India

In addition, I also run the Twitter page The Money Memo - a community of 2600 followers for more in-depth ideas and concepts, with my DMs open everywhere.

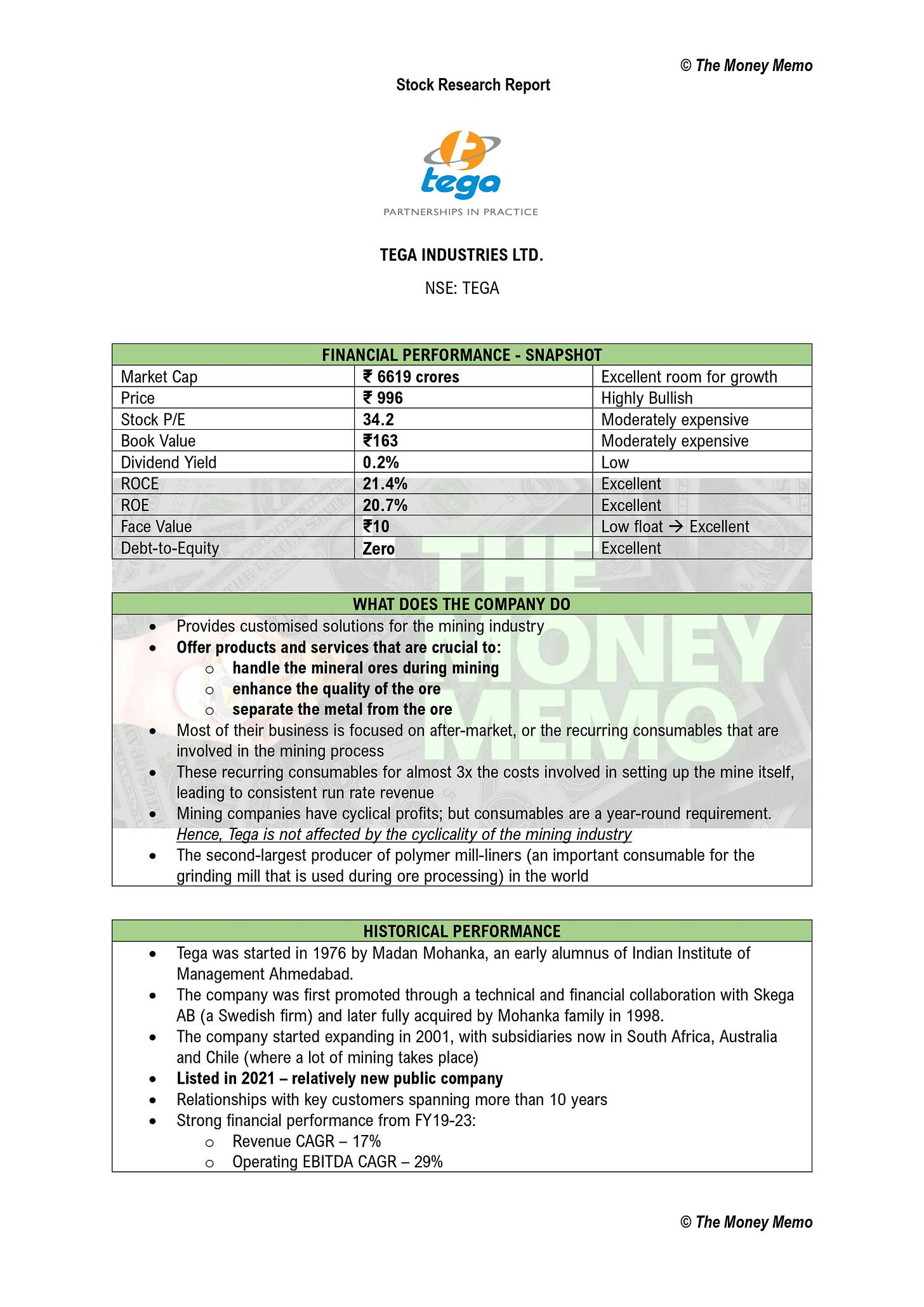

Now let us take a look at our stock pick for this week - Tega Industries Ltd.

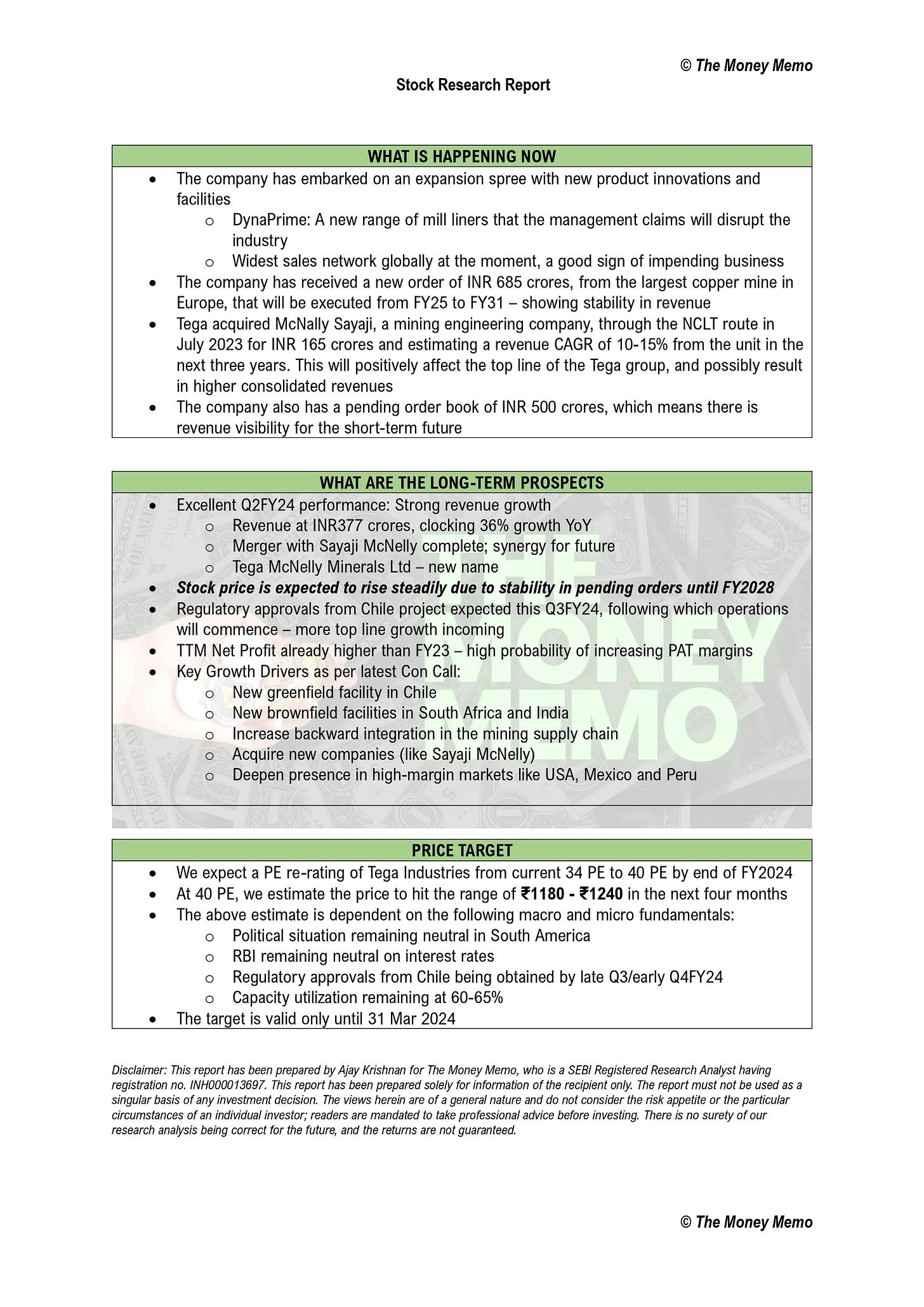

As you can see from the above, the company has excellent fundamentals. However, it’s also moderately expensive when it comes to PE and PB multiples. This is mainly due to the euphoria prevalent in the markets right now after the stunning BJP victories in 3 out of 4 states that went to polls. We see a steady rally in Indian markets up to mid-2024 as FIIs start buying and discount a Modi victory in the General Elections.

Though our price target is aimed for end of FY24, we strongly believe that Tega is a company that has a long runway, especially because of the prudent management, zero-debt levels and also as they are not affected by the cyclicality of the mining industry.

They are also using their cash reserves to acquire distressed companies at very cheap valuations, and then planning to turn them around with their expert human resources and track record of more than three decades in the mining industry domain.

For a better deep-dive, please do reach out to me or consider becoming a paid subscriber - I can guarantee that you will find great value in my research. Keep in mind that I also cover international markets, so you can see more U.S/Canadian company research also coming from The Money Memo, for both free and paid subscribers.

If you liked the research report, please share with your friends to spread the word!

Happy investing!

Disclaimer: This article is for informational purposes only. Please consult your certified financial advisor before investing in any security.